Archive

Crushing Harvard’s Mighty Endowment Fund?

Before I get into my latest topic, I want to follow-up on my Friday comment on pensions leaping back into hedge funds. I was talking to one of the investment professionals who works at an established hedge fund that received an allocation from the $175 million SARA Fund managed by HR Strategies on behalf of the Caisse de dépôt et placement du Québec, Fondaction CSN and Fond de solidarité FTQ.

Before I get into my latest topic, I want to follow-up on my Friday comment on pensions leaping back into hedge funds. I was talking to one of the investment professionals who works at an established hedge fund that received an allocation from the $175 million SARA Fund managed by HR Strategies on behalf of the Caisse de dépôt et placement du Québec, Fondaction CSN and Fond de solidarité FTQ.

This person told me that I should be patient because this is only the beginning and if successful, emerging funds will eventually be seeded. I certainly hope emerging hedge funds in Quebec will be seeded, but remain skeptical. And I repeat: this is public money and HR Strategies should fully disclose the allocations they make to all hedge funds that receive funds in the SARA Fund, including name of funds, amount allocated to each fund, follow-on investments, and most importantly, deal terms (equity stake and fees).

Why am I harping on emerging hedge fund managers? Simple, because the ones I met have years of experience, are trustworthy, focus on niche strategies and they just need a break to raise assets over a critical level. They should be focusing 100% of their time on managing money, not raising assets. And the truth is, there is no better way to create jobs than seeding new funds that are going to grow exponentially in the future. If LPs are worried about seeding, they can allocate via a managed account platform which gives them full control over the portfolio.

The other thing I wanted to bring to your attention is the interview with CPPIB’s Aleks Weiler at the end of that comment. Aleks is the leader of the Greenwich Working Group on best practices and he was instrumental in drafting documents on best practices in alternative investing on portfolio construction and on due diligence. All institutional investors who allocate to alternative investments should take the time to carefully read these documents. I agree with Aleks, don’t rely on a track record; focus on people and process.

Let me proceed to my latest comment. Anthony Effinger and Gilian Wee of Bloomberg report, Handy Enables Smith to Crush Harvard’s Annual Endowment Returns:

Prescient bets against the stock market have helped endowment manager Alice Handy regularly beat the Standard & Poor’s 500 Index. Handy, who manages money for Smith, Barnard and Middlebury colleges at a firm she founded called Investure LLC, has also done something more satisfying: vanquish Harvard and Yale.

Smith College, Handy’s first client and a proxy for 10 others, earned 16.3 percent on its $1.2 billion in the year ended on June 30, 2010, the most recent fiscal year for which data are available. That compared with 11 percent for Harvard University on its $27.6 billion and 8.9 percent for Yale University, which had $16.7 billion. Investure manages $8 billion.

The drubbing wasn’t a fluke, Bloomberg Markets magazine reports in its July issue. Smith beat Harvard over five years, too — 7.3 percent to 4.7 percent — partly because Handy had the guts to bet against U.S. stocks early in 2007 when it looked like the bull market might never end.

Handy, 63, the granddaughter of a Cape Cod cranberry farmer, is modest about her track record.

“All ships need to float in this market,” Handy says. “It’s a very humbling experience to run money.”

Handy started Investure in 2004, catering to schools that wanted to outsource their endowment to get better returns. Small schools have a tougher time attracting talent than Harvard or Yale.

Talent Search

“If you’re not in New York City or Boston, it’s harder to recruit and retain the investment professionals you need,” says Ruth Constantine, vice president for finance and administration at Smith, in Northampton, Massachusetts. Harvard, for its part, once employed Mohamed El-Erian, now chief executive officer of Pacific Investment Management Co., which oversees $1.28 trillion.

Off-campus money management is a growth industry. U.S. endowments and foundations will outsource about $215 billion by 2015, more than double today’s $100 billion, says Kevin Quirk, a founding partner at Casey Quirk & Associates LLC, a management- consulting firm in Darien, Connecticut.

“We wanted someone who worried about the endowment every day — who got up worrying about it,” says Investure client Robert Taylor, senior vice president for finance and administration at the Colonial Williamsburg Foundation, the private institution that runs the restored Virginia town.

‘High-Touch Model’

During most of its seven-year existence, Charlottesville, Virginia-based Investure has been more exclusive than Yale’s Skull and Bones society. Handy closed the firm to new investors in 2007 on concern, she says, that she couldn’t deliver the same level of service to a bigger group. Each of her 11 clients has three investment meetings a year, and that’s just the beginning of the Investure staff’s visits.

“A high-touch model is hard to scale,” she says.

Now, Investure is open again. Handy wants to add one client a year for the next five, she says. Investure just signed its 11th this year: the Houston Endowment, a $1.5 billion foundation that supports education, the arts, health and the environment in the Houston area.

The foundation joins Smith; Barnard College; Dickinson College; Middlebury College; Trinity College in Hartford, Connecticut; the University of Tulsa; the Carnegie Endowment for International Peace; the Colonial Williamsburg Foundation; the Edna McConnell Clark Foundation; and the Rockefeller Brothers Fund. Once on board, a client has Investure manage all of its money.

Virginia Base

The company’s base is in leafy Charlottesville, 116 miles (187 kilometers) southwest of Washington, D.C., because Handy ran the University of Virginia (U.Va.) endowment there for 29 years starting in 1974. A trim woman who wears her hair short, she hits the road in sensible shoes and understated jewelry.

In person, Handy is politely blunt. After a March trip to India to meet with a money manager, she said, “By the time you pay bribes and everything, it’s hard to make a return.” On hedge funds, she says, “Hedge funds are just a fee structure; they aren’t an asset class.”

And she likes hedge funds. During her tenure at U.Va., she pushed the endowment into them and into venture capital long before most schools dared.

“If you’re looking for value, you have to look where other people aren’t looking,” Handy says.

That sort of thinking prompted her bet against the U.S. stock market in early 2007. Many investors were still piling into stocks and real estate investments, the latter borne aloft by low interest rates and lax lending standards. The team at Investure couldn’t find anything to buy.

“Nothing looked attractive, so we said, What is the reverse?” Handy says.

Short the Bull

The reverse was a put option — a derivatives contract that gave Investure clients the right to sell the S&P 500 at a certain price for two years. Investure wouldn’t make money until the index fell 5 percent or more. That made the put less expensive. The firm bought several puts on the same terms starting in February 2007, spreading its bets among Bank of New York Mellon Corp. (BK), Goldman Sachs Group Inc. (GS) and JPMorgan Chase & Co. (JPM)

The purchases began to look smart in October 2007, when the S&P 500 started falling from its peak of 1,565. It plummeted the next year, turning the put contracts into gold. Smith invested $31.7 million in its puts and sold the position for $97.5 million, Constantine says. Colonial Williamsburg made $100 million on its puts, the foundation’s Taylor says.

‘Endowment Insurance’

Investure’s puts generated returns that offset losses on other assets. Smith lost 16.7 percent in the fiscal year ended on June 30, 2009. Harvard’s endowment, by comparison, tumbled a record 27 percent, and Yale’s was down 25 percent, also a school record.

“The put protected us,” Constantine says. “Alice called it buying endowment insurance.”

Handy was born and raised in Wilmington, Delaware, after her Massachusetts-born father, a chemist, went to work at a DuPont Co. facility there. After high school, she returned to her family roots and enrolled at Connecticut College in New London, where she studied economics, and graduated in 1970.

Her husband-to-be got a job at a Hartford, Connecticut, bank. Handy went to work at Travelers Cos. “I said I wanted to work with people, and because I had an economics degree, they put me in the investment office,” Handy says. She ended up in the bond department, which was great, she says, because there were only three managers, including her.

Finding a Home

Handy helped manage the fixed-income portfolio for four years and then followed her husband to Charlottesville when he enrolled in graduate school there. While they later divorced, she found a working home at U.Va., which hired her in 1974 as the first full-time investment officer of its then-$50 million endowment.

She got a quick lesson in market volatility. The Dow Jones Industrial Average plunged to 577.6 in December 1974 from about 850 a year earlier. The slump didn’t sway Handy or the U.Va. investment committee that controlled the endowment. They had about 75 percent of their money in equities and stuck with them, she says. In 1980, she added international shares to the portfolio, just as many non-U.S. markets took off.

Handy also plunged into hedge funds, investing U.Va. money with Paul Tudor Jones of Tudor Investment Corp., with Lee Ainslie’s Maverick Capital Ltd. and with John Griffin’s Blue Ridge Capital Holdings LLC. All three are U.Va. graduates.

“It was very incestuous,” Handy says. “There was a comfort in knowing these people.”

Hedge Fund Bet

After Handy took over Smith’s endowment in 2004, she pushed its allocation to hedge funds and other private partnerships to 36 percent from 14.4 percent the first year.

“That was the single most significant change for us,” Constantine says.

Investure’s main activity is picking firms to manage its clients’ money. One of Handy’s favorites is Appaloosa Management LP, the Short Hills, New Jersey-based hedge fund run by David Tepper. Tepper is great, Handy says, as long as you’re comfortable with big swings in performance. Appaloosa’s flagship fund returned 28 percent in 2010 and 132 percent in 2009 after a 26.7 percent loss in 2008.

“He has a pretty amazing long-term record,” she says. “But you have to love his volatility.”

One of Handy’s most profitable moves at Virginia was investing in venture capital firms, including Crosspoint Venture Partners and Oak Investment Partners in the 1990s, just before technology boomed.

Dodging Tech Crash

By 1999, she had concluded that tech stocks were overvalued. Virginia state institutions, including U.Va., were precluded from investing in derivatives, so one of Handy’s board members went to the legislature and the governor and succeeded in getting the law changed.

Handy bet against $100 million in technology stocks. In March 2000, the tech-heavy Nasdaq Composite Index (CCMP) peaked and then plunged 60 percent in 12 months.

“We had all these new IPOs that had huge gains,” says Don Lindsey, who worked with Handy at U.Va. for 13 years. “We locked in all those gains before the tech meltdown.”

Lindsey is now chief investment officer at George Washington University in Washington, D.C.

The Virginia endowment rose an average of 13.8 percent a year during the last two decades of Handy’s tenure, she says, compared with 10 percent annually for the S&P 500. By the time she left the school, the endowment had grown to $2 billion.

Outsourcing

Handy got the idea for Investure in 2003 after administrators at both Georgetown and Randolph-Macon College in Ashland, Virginia, asked her if she could recommend an investment manager to handle their endowments. “I did a little work on outsourced offices and found that there were very few,” Handy says.

A friend who was a venture capitalist encouraged her to write a business plan, which she shared with Nina Scherago, a former analyst at Lehman Brothers Holdings Inc. (LEHMQ) and a member of the Smith investment committee. She’s now its chairwoman.

Smith had been trying to get other members of the Seven Sisters — a group of selective women’s liberal arts colleges, two of which have gone coed — to pool their money in a new investment office. Others balked, so Smith signed on with Handy.

“She was able to have a steady hand on the portfolio and not panic and make rash decisions,” says Anita Volz Wien, another Lehman alumna who’s now an investment committee member at Smith. She’s also married to Byron Wien, vice chairman of Blackstone Advisory Partners, part of Blackstone Group LP (BX) in New York.

No ‘Woohoo’

In the past two years, Handy has been bottom-fishing, buying beaten-down mortgage securities, bank assets and stock in companies that drill and dig for commodities. She’s also holding cash because of unsettling world events.

“There is so much that is still wrong out there,” Handy says. “You can’t sit back and say, ‘Woohoo! We’re out of the woods.’ We’re trying to find the most opportunistic investments we can make, things that are distressed and have a chance to make money even if the economy doesn’t.”

One distressed asset she likes is the Yellowstone Club, a private ski resort in the Montana Rockies that went bankrupt in 2008. Cross-Harbor Capital Partners LLC, a Boston-based private- equity firm, bought the club out of bankruptcy and is selling both its luxury ski chalets and the land to build new ones.

Investure clients have money in a CrossHarbor fund, which, in turn, is an investor in the club. Investure clients also took a direct stake in the alpine hideaway. Private equity funds like CrossHarbor sometimes solicit such co-investments from clients looking for more direct exposure to an asset. Fees on co- investments are often lower, too.

The investment is an unusual one compared with the stocks and bonds that most endowments buy. Handy is counting on such value plays to keep her clients’ money growing in a tricky world. If she keeps doing well, investment managers at Harvard and Yale risk losing bragging rights to the modest, blunt Virginian yet again.

I like this story for several reasons. First, US endowment funds, just like most investment funds, are dominated by testosterone. Everyone has heard of Harvard’s Jack Meyer and Yale’s David Swensen. Both men deserve their place in the pantheon of great endowment fund managers, but now we have a lady making a big splash. Harvard’s endowment is now also run by a woman, Jane Mendillo. Maybe the new rivalry will be Handy vs. Mendillo.

Second, I like Handy’s contrarian style. She isn’t afraid to buy distressed assets or go against the grain, shorting markets when there is nothing to buy. Of course, to be good at that game, you have to know when to pull the trigger. Third, Ms. Handy proves that you can outsource properly when you know what you’re doing. Even though the bulk of hedge funds are selling beta as alpha, there are incredible hedge funds out there that are worth investing with. And despite popular myths, the top hedge fund managers are not all based in New York, Chicago or London or men! (come to Montreal and I’ll prove it to you).

Finally, while puts were good protection against downside risk in 2008, the ultimate protection were good old bonds, which enabled Healthcare of Ontario Pension Plan (HOOPP) to escape that crisis practically unscathed. I consider HOOPP to be one of the best funds in the world. If I could only change their mindset about investing in hedge funds using managed accounts, I’d then introduce them to some excellent managers worth investing with. In the meantime, perhaps Ms. Handy’s team will contact me. I’ll show them real Quebecois alpha that’s worth paying fees for.

All Roads Lead to Athens?

Stephanie Levitz of the Canadian Press reports, Harper uses Greece trip to teach political lesson to his government and theirs:

Stephanie Levitz of the Canadian Press reports, Harper uses Greece trip to teach political lesson to his government and theirs:

Prime Minister Stephen Harper brought a message from Canadian politics to his Greek counterpart Saturday.

He said that sometimes, a government needs to act even if the opposition doesn’t want to co-operate.

Harper arrived in Greece for his first bilateral visit as the country is being rocked by protests and political turmoil over its debt crisis and the austerity measures required to get the deficit under control.

For the past year, Greece has relied on a $155 billion package of bailout loans from other EU countries and the International Monetary Fund.

But the first round of austerity measures agreed to in return didn’t ease market concerns that the Greek economy can be salvaged.

On Friday, Greek Prime Minister George Papandreou failed to get all-party support on new measures, jeopardizing the next round of bailout funds from the European Union and the IMF.

But on Saturday, Harper said he’s confident the Greeks will get the situation under control.

“I know from experience that it is not unusual for opposition parties to refuse to co-operate with government,” Harper said.

“But governments have a responsibility to act and I certainly honour the determination of Prime Minister Papandreou and the very difficult actions he’s had to take in response to problems his government did not create.”

Harper said he’s using the Greek situation as an example.

Accompanying Harper on the trip is Treasury Board President Tony Clement, who is of Greek heritage. Clement will be in charge of making the $4 billion in cuts to government services next year as Canada pays down it’s deficit.

Harper said he wanted Clement to sit in on the meetings to show him “we have nothing like the challenges faced here in Greece. He has a comparatively easy task.”

Clement also signed a youth mobility agreement with Greece as part of the trip. The agreement helps facilitate work and tourist trips by young people.

But the challenges facing Greece did hit home for Harper.

He was originally supposed to stay in a hotel fronting the Hellenic Parliament but was moved to another after thousands of protesters had amassed there late Friday.

Harper came to Greece following the G8 meetings in France, where leaders discussed the global economic crisis, including Greece’s dilemma.

He had said going into Athens that he was looking forward to hearing about the situation from the Greek perspective. He received a full briefing on Saturday as he visited Papanderou.

He wouldn’t comment on what he heard

“We have every confidence that our Greek hosts here and our European friends will continue to deal with the matters so the global economy can continue to grow,” Harper said.

There are about 250,000 Canadians with Greek heritage and several within the prime minister’s circle, including Clement and newly-elected member of parliament Costas Menegakis. Both are on the trip.

They were part of a business roundtable Harper held earlier in the day with a group of Canadian and Greek executives, including representatives of Coca-Cola and Bombardier.

Harper’s director of communications, Dimitri Soudas, is also of Greek origin.

On Sunday, Harper will visit the village of Kalavryta, where members of Soudas’ family still live.

Harper will be there to pay his respects at a memorial for the Greek men and boys rounded up and summarily killed by the Nazis during the Second World War. They included Soudas’ grandfather.

The prime minister had done very little international travel prior to entering politics, but he said Saturday Greece was one of the countries that had intrigued him.

“I have always been fascinated by your country as a cradle of democracy and this was one of the first places in the world I visited in fact 34 years ago as a young man,” Harper told Philippos Petsalnikos, the Speaker of the Hellenic parliament.

“And notwithstanding the challenges that we read about, I have observed the remarkable progress the country has made over the past several decades.”

Later in the day, he and his wife Laureen had a chance to take in some of what Greece looked like centuries ago.

They visited the Acropolis museum in Athens and then the Acropolis itself.

As he toured the Greek ruins and posed for photos in front of the Parthenon, Harper pointed to the massive columns behind him and joked: “I should build this.”

The next time Prime Minister Harper visits Greece, he should tour the islands, especially the island of Crete where my sister now lives (she used to work at the Canadian embassy in Athens). There, he can visit many historic sites, including the Suda Bay War Cemetry in Crete where Allied and German casualties are buried (this is an incredible site to visit).

As for Treasury Board President Tony Clement, some friendly advice. I just completed a contract at Industry Canada here in Montreal, the ministry which he was previously in charge of. As I stated in my open letter to Prime Minister Harper following the elections, cut the fat across all government departments and Crown corporations. People think I’m a fiscal liberal, but when it comes to the public sector, I think we need to increase the harmonized sales tax (HST) and examine spending at every single government department by evaluating the services they provide and cut all fat out of their budgets. (Hint: Some departments have lots of fat to cut while others are running bare bone operations and are dangerously close to not providing adequate services).

I do like the youth mobility agreement with Greece which helps facilitate work and tourist trips by young people. When we were teenagers, my brother and I went touring all over Greece with other Canadians of Greek origin from across Canada. Apart from being a blast, we also got to visit many important historic sites in northern Greece and the Peloponnese. I recommend such trips for all young Canadians, not just those of Greek origin. I also recommend they bring along and read a copy of Henry Miller’s classic, The Colossus of Maroussi, as they tour Greece (this is one of my favorite books).

From my vantage point, the trip to Greece is a little bit pleasure but mostly political. While Canada is definitely in better shape than Greece, there are some eery similarities. In particular, household debt in Canada is at record levels, spurring a Canada bubble of historic proportions, which is also aided and abated by Canada’s mortgage monster. When this bubble pops — and it eventually will — the economy will get hit hard and our Canadian dollar will tank (still think if CAD reaches 1.10, it’s a short!) and our bonds will rally (that’s why Canadian bonds are still valuable).

There are a few politicians, senators and senior policymakers in Ottawa who read my blog. They have privately told me they’re worried about our debt profile and what will happen to our economy if China slows and unemployment or interest rate rise. Making a pit stop in Greece following the G8 meeting and hinting that we should pay attention to what is going on there because the same can happen here is a bit far-fetched, but you never know. I happen to believe a big slowdown in Canadian real estate lies ahead, and along with it, unemployment will rise and the economy will falter.

As for my ancestral home of Greece, it was last September when I met up with Petros Christodoulou, the new head of the Public Debt Management Agency, in Athens. He told me that “restructuring was not an option,” and asked me my thoughts of Greek “diaspora” bonds. Good luck peddling those now that things have gone from bad to worse in Greece, no thanks to what Stiglitz correctly points out to are shortsighted austerity policies which are preventing countries from creating jobs needed to generate economic growth.

In the region of Athens, residential and commercial real estate development are down a whopping 88% and in Crete, where my brother-in-law runs a building materials company, real estate activity is down 85% from last year. He had to fire five employees and he is still trying to collect monies owed to him by hotels that are sending cheques that bounce. The Greek judicial system is bogged down by tons of cases where businesses are owed money, even by the Greek government (I heard of one major tourist operation in Athens that went bankrupt because the government wasn’t paying them money they owed).

Too much austerity is killing the Greek economy. People are losing their jobs, and even those that still have them are seeing their wages slashed. There have been savage cuts in the private sector and now the focus is on cuts in the public sector (when the economy is extremely weak!). Banks have all but stopped lending money and consumers are retrenching because they fear the worst is yet to come. It’s a disaster.

Having said this, I’ll tell you exactly what’s going to happen. Greek assets are going to go on sale — a fire sale to be precise. Big private equity shops across Europe, North America and the Middle East are salivating at the thought of buying state assets in Greece for next to nothing. As in every crisis, some funds will profit in a huge way.

And while restructuring looks all but certain now, don’t discount Greek bonds or the National Bank of Greece as dead. Depending on what the ECB and European leaders decide, there may still be opportunities with these investments selling at distressed levels. Below, CCTV reports on the PM’s visit to Athens.

Pensions Leap Back to Hedge Funds?

Steve Eder, Gregory Zuckerman and Michael Corkery of the WSJ report, Pensions Leap Back to Hedge Funds:

Steve Eder, Gregory Zuckerman and Michael Corkery of the WSJ report, Pensions Leap Back to Hedge Funds:

Public pension plans are lifting hedge-fund investment, seeking to boost long-term returns despite losses suffered in some funds in the financial crisis.

Also, pension officials are using the historically strong returns of hedge funds to justify a rosier future outlook for their investment returns. By generating more gains from their investments, pension funds can avoid the politically unpalatable position of having to raise more money via higher taxes or bigger contributions from employees or reducing benefits for the current or future retirees.

The Fire & Police Pension Association of Colorado, which manages roughly $3.5 billion, now has 11% of its portfolio allocated to hedge funds after having no cash invested in these funds at the start of the year.

“There has been some deserved criticism of hedge funds, but many hedge funds during the market downturn in 2008 did better than the S&P 500,” said Dan Slack, the chief executive of the system.

While pensions have been investing in private equity and what are called alternative investments for many years, hedge funds have represented a smaller part of their portfolio. The average hedge-fund allocation among public pensions has increased to 6.8% this year, from 6.5% for 2010 and 3.6% in 2007, according to data-tracker Preqin.

The number of public pension plans investing in hedge funds has leapt 50% since 2007 to about 300, according to Preqin. State pension systems had $63 billion invested in hedge funds as of their fiscal 2010 and are expected to invest another $20 billion in hedge funds in the next two years, according to a recent report by consultant Cliffwater.

Hedge funds typically bet on and against stocks, bonds or other securities, often using borrowed money. Investors have been giving more cash to hedge funds in recent months, as they regain comfort with markets after two years of solid returns.

On average, hedge funds as a class have delivered for large pension funds that have dabbled in them over time, data show. Large pension funds scored median annualized returns of 6.8% investing in hedge funds in the past decade, compared with 5.7% from stocks and 6.1% from bonds, according to Wilshire Associates, an investment consultant in Santa Monica, Calif. Private equity delivered 6.7%.

While hedge funds outperformed stocks in the financial crisis as an industry, some individual funds suffered significant losses or closed.

When looking at average hedge-fund performance, “there is nothing magical being created,” said Steven Foresti, head of the investment research group at Wilshire. “They are not a panacea.”

David St. Hilaire, who oversees the $230 million City of Danbury Retirement Plan, created hedge-fund investments for his fund’s comparatively smooth recovery from the financial crisis and calls them helpful from an actuarial standpoint because of the returns they project. He said the fund has 27% of its assets in alternatives and that this percentage is likely to get bigger.

In March, the New York City Police Pension Fund voted to invest in a firm that puts money into a variety of hedge funds, the first such move by the city’s pension funds, which manage $117 billion. In the past few months, two more New York City pensions made the same decision. Together the three funds invested $450 million with hedge-fund firm Permal Group.

It is a “first step into hedge funds,” said Larry Schloss, the New York City chief investment officer. He says he hopes the investment will help the city’s pension system avoid the “wild ride” it has taken in recent years. The system had $115 billion before market tumble in 2008, when it fell to $77 billion.

New Jersey’s State Investment Council, which sets investment policy for the state’s pension fund, voted last week to raise the target allocation for hedge funds to 10% from 6.7%, which would make hedge funds the $73 billion fund’s largest alternative investment asset.

The bullishness comes despite a moment in the financial crisis when the fund found itself adding cash to hedge funds it was invested in that were wobbling.

“Whatever problems we’ve had, hedge funds have been our best performer among our alternatives,” said Andrew Pratt, a spokesman for the New Jersey Treasury, which oversees the pension fund’s investment operations.

By contrast, the Pennsylvania State Employees’ Retirement System has been paring its hedge-fund allocation to about 15% at the end of 2010 from about 26% at the start of 2008.

The $25 billion pension system was disappointed after suffering a 16% loss on its hedge-fund investments in the financial crisis despite pursuing a so-called absolute return strategy that has a goal of no losses, a pension fund spokesman said.

“We see hedge funds as having a smaller, though still significant and important role in the asset mix,” spokesman Robert Gentzel said.

I have already written a comment asking whether hedge funds have grown too large. Let me explain why the current mania pension funds have with hedge funds is a double-edge sword. On the one hand, underfunded pensions are looking for absolute returns and following the 2008 crisis, they are managing their liquidity risk more closely. For example, the Ontario Teachers’ Pension Plan manages liquidity risk very carefully, and invests in hedge funds almost exclusively via a managed account platform, allowing them to have full control over the liquidity of the underlying funds.

Private equity and real estate have been strong alternative asset classes over the years but they’re liquidity profile may not be optimal for mature, underfunded pensions managing liquidity risk very carefully. If they need to raise cash fast, they can’t just sell a building or their stake in some private equity fund quickly (if they do, it will be at a deep discount). Even in the hedge fund space, the bulk of the assets are going to TAA and global macro managers, Long/Short Equity and commodity trading advisors (CTAs). Why? Because they’re scalable strategies and large pension funds prefer writing $50, $100 or $200 million tickets to a few well known established “brand” names than writing small tickets to many less liquid absolute return strategies (more on this below).

On the other hand, the mania with hedge funds is sowing the seeds of the next financial crisis. It won’t happen anytime soon, but when billions are being poured into hedge funds, regulators better pay attention to macro systemic risk. The role that large hedge funds and large bank prop desks played during the last credit crisis is still poorly understood. Economists still can’t figure out the linkage between hedge fund asset growth, liquidity, credit conditions, financial leverage, asset bubbles, financial crisis and their effect on the real economy.

Over the last two and half years, I’ve been getting blasted on Zero Hedge for telling investors to keep buying the dips. My view remains that the financial oligarchs will do whatever it takes to reflate risk assets and introduce some inflation in the system. By allocating more and more assets into hedge funds, public pension funds are able to bypass the leverage constraints they have in their traditional assets and they are also introducing a boom in liquidity into the global financial system, thus helping the financial oligarchs achieve their goal of relating risk assets and introducing inflation in the economic system. Absolutely nothing has changed, which is one reason why I expect a lot less volatility going forward (less, not more because everyone will be bidding up risk assets).

Eventually the music will stop, most likely when the Fed signals the start of a rate hike campaign, but there is so much liquidity and leverage in the financial system that it will take several rate hikes before we see speculative activity tapering off in any meaningful way. In the meantime, global pensions and sovereign wealth funds will keep pouring billions into hedge funds and other alternative asset classes.

Let me make a few suggestions to pension funds looking to invest in hedge funds. If you don’t know what you’re doing in hedge funds, and don’t have the in-house expertise to select your own managers, you’re better off paying that extra layer of fees and partnering up with a top fund of funds (or even a smaller, less well known one) that will help you invest in hedge funds. You are better off selecting one or two fund of funds, writing them a big ticket and using this relationship to develop in-house expertise to then go the direct route.

Last Friday, I chatted with Rick Dahl, CIO at the Missouri State Employees’ Retirement System (MOSERS), on many pension related issues. I am going to write a full comment on MOSERS because they’re the best US public pension plan. There are a lot of reasons why and chief among them is they got the governance right. I credit Rick and Gary Findlay, MOSERS’ Executive Director for their work on getting the governance right. I also think highly of Rick on a professional and personal level. When it comes to managing a pension fund, you can’t ask for a better CIO.

Rick was telling me when MOSERS first got into hedge funds, they wrote two big tickets to Blackstone and PAAMCO which they still use as advisors. However, Rick was smart about the way he allocated to these fund of funds. At the time he invested significant amounts which represented a sizable chunk of their assets and he signed an investment manager agreement which stipulated knowledge transfer where his staff could visit these fund of funds managers on their premises and learn from them for two or three days a quarter. Importantly, you don’t just want to give money to a fund of funds, you want to learn from them and squeeze everything you can from the relationship without abusing them.

I mention this because far too many public pension funds are clueless about investing in hedge funds and typically follow the advice of pension consultants. Some consultants are good but most of them are terrible and haven’t the faintest idea of what’s in the best interest of their pension clients. Worse still, many consultants and prime brokers with cap intro groups are fraught with conflicts of interest and will recommend hedge funds or fund of funds that they invest in or trade with. Again, there are excellent independent consultants and third party marketeers but they’re a dying breed.

Let me wrap things up by getting back to a previous comment on Quebec’s absolute return fund. I’ve been hearing that HR Strategies, the fund of funds mandated by the Caisse de dépôt et placement du Québec, Fondaction CSN and Fond de solidarité FTQ to run the $175 million SARA Fund, has already started disbursing funds. The problem is that the lion’s share is going to already well established funds run by managers that are already multi-millionaires.

I have no issues with these successful, established managers and want them to continue on this path of success, but I sincerely hope HR Strategies will also seed some new funds run by younger managers with tremendous potential. Let me repeat what I stated before: there are exceptional, young absolute return managers in Quebec that are not getting the support they rightly deserve by Quebec’s largest financial institutions (Caisse, PSP Investments, Desjardins, Fondaction, FTQ, National Bank and Hydro Quebec).

This is a tragedy for Quebec’s finance community. I was at the gym the other day after meeting a couple of these new talented managers and my trainer and I started chatting about hedge funds. He’s Canadian of Lebanese origin and it turns out his friend is Tim Barakett’s father. In case you don’t know, Tim Barakett is the founder of hedge-fund firm Atticus Capital, which handed $3 billion back to his investors two years ago and closed down his flagship fund to spend time with his family. Along with his brothers, they are arguably the most successful investment managers from Quebec (apart from, of course, the Desmarais family, one of the richest and most powerful families in Canada).

I mention this because apparently Tim Barakett once said to become successful, you need to get out of Quebec. It’s sad but true. Most of the ultra successful Quebecers in finance that I know got out of Quebec. This needs to change. HR Strategies and Quebec’s large institutions should place more emphasis on seeding Quebec absolute return managers, just like Ontario Teachers’ did in Ontario.

Going primarily with established managers is good for HR Strategies when it markets its fund of funds to investors, but it doesn’t create new jobs and it doesn’t raise the profile of Quebec’s financial industry (HR Strategies should publicly disclose which funds got what amounts and based on what criteria and deal terms). These large and powerful institutions need to step up to the plate and start seeding new managers with tremendous potential. God knows we have plenty of them right in our backyard that are being ignored for purely political reasons.

This really pisses me off. I feel like starting my own seed fund. It will be run on a managed account platform, fully transparent, zero operational risk, and invest in diverse strategies run by Quebec’s young but talented absolute return managers. If pension funds were smart and not engaging in cover-your-ass politics, they would be actively seeding young, talented absolute return fund managers.

If you’ve seen what I have seen in Montreal in terms of quality managers with years of experience at large shops struggling to raise more assets for their fund, you would be utterly dismayed. These managers deserve more assets and they need more financial support. If you’re a large global asset manager or even large family office, please contact me (LKolivakis@gmail.com) and come visit our beautiful city. Let me show you why I am beating the drum hard on Quebec’s talented absolute return managers. They can compete with the best hedge fund managers in the world. I should know, I used to invest in them.

***Public Disclosure***

Public disclosure: I am not in the cap intro business, at least not yet. I have no signed legal agreements with any of the funds that I am discussing on my blog and have not met all of them. I am very impressed with the ones I have met and have absolutely no qualms recommending them to public pension plans and sovereign wealth funds. Importantly, I would never recommend any fund that I wouldn’t invest in myself.

Below, Aleks Weiler, senior portfolio manager at CPPIB, says it like it is. Don’t trust the track record, understand why people are making money, and focus on the character of the fund managers. Are they trustworthy?

http://plus.cnbc.com/rssvideosearch/action/player/id/1297151737/code/cnbcplayershare

Boom For Canadian Private Equity?

Pav Jordan of Reuters reports, Mood upbeat for Canada private equity conference:

Pav Jordan of Reuters reports, Mood upbeat for Canada private equity conference:

A resilient Canadian economy is drawing levels of private equity investment not seen since 2008 and attracting global technology giants like Google, Groupon and Microsoft.

Experts say technological innovation is blurring the traditional lines between venture capital, which typically invests in early stage technologies, and private equity, which is crossing increasingly into the sector that in Canada helped give birth to companies like Research In Motion, maker of the BlackBerry smartphone.

“When you have the major large-cap, technology companies in North America sitting on $500 billion in cash reserves, and with very aggressive growth plans for their own businesses, in an environment that is changing at light speed, they can’t get there just by their own research and corporate development efforts, so they need to get there through acquisitions,” said Steve Hnatiuk, chairman of the Canadian Venture Capital and Private Equity Association’s annual conference.

The CVCA’s meeting in Vancouver this week is attracting a record 600-plus participants, who between them represent hundreds of billions of dollars in investment capital.

This year’s participants will for the first time include U.S. technology and social networking giants that are looking to Canada to buy technologies they cannot develop in-house, as well as the Canadian pension funds that were some of the world’s largest private equity investors in recent years.

The Canada Pension Plan Investment Board, the country’s second-largest pension fund administrator, will be a big winner when Microsoft buys Internet phone service Skype for $8.5 billion in its biggest-ever acquisition, placing a rich bet on mobile and the Internet to try to best rivals such as Google.

Private equity firm Silver Lake, eBay Inc and investors including CPPIB are seen making $5 billion on the deal, tripling their investment.

BOOMING LIQUIDITY

Google, Microsoft and RIM, have all announced acquisitions in Canada over the past year, quietly creeping into the country’s venture capital landscape.

One CVCA panel will focus on the rise of Internet companies like Zynga, Facebook, Amazon, Google, Groupon and PayPal PAPXX.O, which have become multibillion-dollar operations in recent years even as traditional media companies decline.

But industry players say new business models that address the changing investing landscape mean problems, pitfalls and opportunities in private equity and venture capital.

“The venture community and even the PE (private equity) community are going through some structural change, and have been for the last three years,” said Ross Bricker, chief executive of the AVAC venture capital fund from Calgary, Alberta.

“Over the last year and a half, we’ve seen a cautious return to investment,” said Bricker, who has about 55 venture companies in his portfolio.

Canada’s famed recession-era resilience has also made it a magnet for private equity and venture investors.

Soaring liquidity, backed by corporate players with stock valuations that have recovered from crisis-lows, and a budding appetite for initial public offerings, are creating a dealmaking environment not seen since 2008.

“The last 12 months or so have seen an obvious and clear uptick in the market generally, and I think what we’ll see this week is an entirely different mood among the investment community,” said Rick Nathan, managing director at Kensington Capital Partners, a Toronto-based firm with some C$500 million ($510 million) in capital under management.

“I know just from my own schedule that there’s a lot of people that I want to meet with and who want to meet with me, and that’s great,” said Nathan, who is moderating a panel on Thursday on asset allocations.

The conference is also one of the largest of its kind in North America and attracts global and regional investors, including some of the world’s largest venture capital players.

In related news, Takeover Chatter reports that CVCA-OMERS aims to build private equity portfolio:

OMERS, one of Canada’s largest pension fund administrators, aims to bolster its private equity portfolio as it builds on a strategy of buying companies and working with existing management to enhance value, a senior OMERS executives said. OMERS, or Ontario Municipal Employees Retirement System, will look for deals in the C$100 million ($102 million) to C$500 million range, the size at which it usually targets acquisitions, Jim Orlando, managing director for private equity, told Reuters in an interview. “Net-net, we will be buyers, and net-net, we intend to increase the number of portfolio companies we have under management,” Orlando said ahead of the annual Canadian Venture Capital and Private Equity Association conference in Vancouver. Teaming with private equity firm Berkshire Partners LLC, OMERS earlier this month said it would purchase Husky International from Canadian takeover shop Onex Corp (OCX.TO) for $2.1 billion. It was the latest in a recent flurry of secondary buyouts — where one private equity firm sells to rival buyout firm.

Onex made money off the Husky deal, but what remains to be seen is how OMERS will turn around and sell it a higher price. I exchanged thoughts with a senior pension fund manager who commented the following on OMERS:

They have big ambitions, bigger than we have. We are trying to make a profit, not a relative percentage, and don’t care how we execute. There are many clever ways to transact, direct is just one option. If they have staying power, no reason why they are destined to fail. I see more deal makers than investors over there, so we shall see how it goes. Looks like mostly co-investing so far, which is no bad thing, so not sure what they are doing is worthy of much attention. They still have the largest part of their portfolio in funds, as do OTPP and CPPIB, so unless they disclose their direct performance and separate club and co-investment from their own deals, one will never really know where the true portfolio attribution lies.

I also think it’s mostly co-investing, which as this person says, is not a bad thing. More and more Canadian pensions are bringing assets internally but the truth is they do not disclose the performance of direct deals or internal absolute return strategies in public markets. Why? Because of reputation risk. If things are going well, no problem, but if someone loses billions, they send him or her away with a nice cushy package and hush it all up.

How do I know this? I’ve seen senior managers lose billions, get fired with a cushy severance and it’s all covered up so that the media doesn’t get a whiff of it. I’m telling you, I can write a book on the stuff I’ve seen in the pension industry, and it’s not all pretty. Every single pension fund has skeletons they want to keep hidden from the public. To be fair, you can say the same of any large organization, but I hold public pension funds to a higher standard.

Getting back to the initial article on the Canadian economy drawing levels of private equity investment not seen since 2008, that makes me very nervous. Why? Because typically PE activity picks up strongly at the top of the market. The Canadian economy is firing on all cylinders but the Canada bubble fueled by Canada’s mortgage monster will eventually burst, and when it does, Canadian private equity will get clobbered.

Chanos vs. China?

Svea Herbst-Bayliss and Matthew Goldstein of Reuters report, Top hedge fund chiefs: short green tech, store gems:

Svea Herbst-Bayliss and Matthew Goldstein of Reuters report, Top hedge fund chiefs: short green tech, store gems:

Bet against solar energy, says famed short seller James Chanos. Squirrel away gems, advises bond guru Jeffrey Gundlach. Go long on discount retailer Family Dollar, counsels activist investor Bill Ackman.

These and other hot — or unusual — ideas emerged on Wednesday from an annual conference where top hedge fund managers pitch their best investment ideas.

Chanos threw cold water on alternative energy companies, saying that shares in wind turbine maker Vestas Wind Systems and solar panel maker First Solar Inc likely will fall.

Arguing that alternative energy may not create the jobs politicians predict, Chanos said he would likely offend the green movement with his bets.

“The cost of wind is 50 percent more expensive than natural gas,” Chanos said, adding that Denmark-based Vestas would be a good company to bet against or sell short.

The environmental benefits of solar power are also questionable, he said.

Chanos said he is certain that he is on the right path on First Solar because top managers are leaving the company. “We advise you to heed their warnings,” he said, drawing both applause and laughter.

Ackman, who has cemented his reputation as a polite activist, said his new idea is on the passive side — indeed it is not even his own, but investor Nelson Peltz’s idea. He likes retailer Family Dollar Stores Inc for being accessible to shoppers and selling unique and inexpensive products.

While lagging behind chief rival Dollar General, its managers are trying to close the gap, and the company may be a buyout candidate for private equity firms, he said.

Retailers seem to be popular. HSN Inc which runs a home shopping television network, rose 5.3 percent after KKR’s Bob Howard recommended it. Crosstex Energy Inc shares rose 11.3 percent after Harbinger Capital’s Philip Falcone said the company’s shares, which traded the day before at about $9.13, could rise to $18 to $20.

Most of the speakers touted what they already owned. Trian Fund Management’s Peter May, who is Nelson Peltz’s partner, talked about jeweler Tiffany and Co. He did not discuss Family Dollar, the idea Ackman presented, even though he owns it and his bid for the company was rejected in March. Dinakar Singh, who founded TPG-Axon Capital, likes telecom company Sprint Nextel Corp.

Greenlight Capital’s David Einhorn, whose fund long has owned shares of Microsoft Corp, again touted that stock, but he did it with a twist — he called for the software company’s board to oust CEO Steve Ballmer.

“Almost everyone agrees that it is time for the Microsoft board to tell Steve Ballmer lets give someone else a chance,” he said.

The industry’s elder statesman Carl Icahn plugged his own company and said the management is good and he would like to continue to acquire companies.

“We like to do it friendly,” he added.

Gundlach, lacing his talk with slides of artwork by Pablo Picasso, Andy Warhol and others, forecast the U.S. economy’s problems would escalate and that investors should protect themselves.

However, instead of recommending gold, a common safe haven, Gundlach urged investors to buy gemstones. “For real wealth preservation portability has got to be an issue.”

But the bulk of speakers did not surprise.

Steve Eisman, who made his reputation with a bet against subprime mortgages, said investors may be down too much on financial stocks, and said there were some gems in property and casualty insurance.

He said there are three ways to play them, beginning with buying insurance brokers. Next, investors could buy large reinsurers, and the very brave could buy the bigger and more diversified property and casualty company stocks. He offered a chart of the companies, but did not pick any in particular.

“When the cycle turns, the upside in earnings could be considerable,” he noted.

I agree with David Einhorn, time for Steve Ballmer to leave Microsoft. He’s done absolutely nothing for shareholders. As far as Chanos, the FT blog beyondbrics comments, Chanos: short China, in New York:

Poor Jim Chanos. The man who has made headlines in recent years for his strident bearish call on China has run out of stuff to short.

His latest suggestion is to short New York-listed Chinese stocks – if only he could get his hands on them. Other people, it seems, have got there first.

Chanos sees shorting US-listed China stocks as a great way to broaden his wider bet against China as a whole. Bloomberg reports:

“Almost all of them have odd looking financial statements,” Chanos, the president and founder of New York-based Kynikos Associates LP, said on Bloomberg Television yesterday. “We wish we could borrow almost all of them.”

But that’s easier said than done – with some stocks seemingly impossible to get hold of in order to sell/short them. More from Bloomberg:

Renren Inc., a Beijing-based social-networking company that went public in the U.S. earlier this month, is among the most expensive U.S. equities to short. The stock is difficult to borrow with 72 percent of the lendable supply out on loan, according to Data Explorers, a New York-based research firm.

Short sellers have borrowed 96 percent of Beijing-based China Shen Zhou Mining & Resources Inc. (SHZ)’s lendable supply, meaning there is almost no equity available for short sellers to bet against. Its shares are also among the most expensive for short-sellers to borrow according to Data Explorers.

It’s easy to see why. Aside from the growing concerns over financial statements, as highlighted by the SEC probe launched this week into Longtop, the stocks in many cases just aren’t that attractive.

Of 453 US-listed Chinese stocks, only 7 of them have ever paid a dividend. Of that same list, only 265 have a booked a dime of profit, while many of them have seen their share price fall off a cliff this year.

Some of those that haven’t are trading at eerily high multiples. Baidu (BIDU:NSQ) – China’s Google – trades at 71 times this years earnings, while Sina (SINA:NSQ) – other internet portal – trades at 132 times earnings. And then there’s elong (LONG:NMQ) – the travel website – which, despite its impressive growth prospects, already trades at a nose-bleed-inducing altitude of 246 times earnings.

Which raises the question: what took Chanos so long?

Before you go shorting BIDU or SINA, you should check out the detailed institutional holdings on BIDU and SINA. There are some elite funds like Coatue Management and others that increased their positions on both companies during Q1 2011. I trust what Coatue and other elite funds are actually doing more than what Chanos is saying to mainstream media.

And what about Chanos’ call on First Solar and solars in general? Have a look at price action on First Solar (FSLR), and Chinese solar companies LDK Solar (LDK), Renesola (SOL), Suntech (STP) and Yingli Green (YGE) during Wednesday’s session:

The drop in Chinese solars has been beyond insane in the last couple of weeks. Again, check out LDK Solar’s chart:

Look at the volume on LDK Solar over the last week. According to Yahoo Finance key statistics, LDK Solar is now trading at a trailing P/E of 2.7 and a forward P/E of 2.6. Yes, it has lots of debt, but it isn’t going bankrupt, it’s not “another Chinese fraud” and with all due respect to Jim Chanos, the environmental benefits of solars are not questionable nor are the costs related to solar energy.

I’ll tell you what’s questionable, the sneaky practices of big banks and big hedge funds which routinely and systematically engage in naked short selling of solar shares using multi-million dollar computers, bringing the prices down to scare retail investors away so they can scoop up a ton of shares on the cheap. I wouldn’t be surprised if they bring LDK Solar down to $5 or lower again and I’ll be ready to scoop up more shares.

Jim Chanos has become a claptrap for big hedgies. He made a great call on Enron years ago but he’s way off his realm of expertise when it comes to China or solars. If you don’t believe me, go check out the institutional holdings on First Solar and you be the judge. When it comes to Chanos vs. China, I’m putting my money where my mouth is, going long Chinese solars and shorting Chanos!

More Spying on Elite Funds – Part 2

A follow-up to my last comment on spying on elite funds. We begin with an article by Naked Value on Seeking Alpha, Paulson & Co.’s Biggest Buy, Biggest Sell and Top Holdings. You’ll notice that unlike Dodge and Cox, Paulson & Co sold all their Pfizer shares, and initiated a new position in Hewlett-Packard Company (HPQ).

A follow-up to my last comment on spying on elite funds. We begin with an article by Naked Value on Seeking Alpha, Paulson & Co.’s Biggest Buy, Biggest Sell and Top Holdings. You’ll notice that unlike Dodge and Cox, Paulson & Co sold all their Pfizer shares, and initiated a new position in Hewlett-Packard Company (HPQ).

Unlike Soros, Paulson & Co is still betting big on gold, owning a significant stake in SPDR Gold Trust (GLD) and expects a continued recovery, and as such it thinks banks like Citigroup (C) will continue to benefit. The fund also owns Anadarko Petroleum Corp (APC) and Transocean Limited (RIG), which is the company Ontario Teachers’ bet on and made a bundle on.

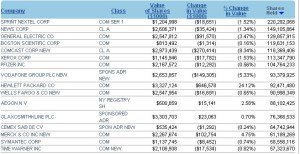

Are you confused? Don’t be. You should be using the tools on the NASDAQ website to slice and dice the portfolios of these elite funds. For example, clicking on the % change in value header at the top of the fourth column will show you Paulson & Co’s new holdings (click on image to enlarge):

Note that apart from Hewlett-Packard mentioned above, Paulson & Co made a significant new investment in Weyerhaeuser (WY), buying up 31,700,200 shares during Q1 2011. Share prices for both companies are well off their highs, and if the fund did their homework, these could yield excellent returns going forward.

Note that apart from Hewlett-Packard mentioned above, Paulson & Co made a significant new investment in Weyerhaeuser (WY), buying up 31,700,200 shares during Q1 2011. Share prices for both companies are well off their highs, and if the fund did their homework, these could yield excellent returns going forward.

When analyzing 13F quarterly filings, it’s important to look at new holdings, not just top holdings. For example, looking at new holdings for Dodge and Cox which I neglected to do in my last comment, you’ll notice that they bought a significant stake in Motorola Mobility (MMI) and Microsoft (MSFT) during Q1 2011 (click on image to enlarge):

Let’s move on to Soros Fund Management. First, start from tickerspy’s hedge funds and click on Soros Fund Management which will bring you to this page. I noticed a significant new holding in Adecoagro (AGRO), a company which engages in the agricultural and agro-industrial businesses in South America. I went on the NASDAQ website, typed in AGRO at the top and then went to detailed institutional holdings which you’ll find on the left-hand side of the blue box. From there, I found Soros Fund Management and looked into their top holdings (click on image to enlarge).

Apart from Adecoagro, which is their top holding reported in Q1 2011, you’ll notice a big increase in their holdings of Motorola Solutions (MSI) and Wells Fargo (WFC).

Apart from Adecoagro, which is their top holding reported in Q1 2011, you’ll notice a big increase in their holdings of Motorola Solutions (MSI) and Wells Fargo (WFC).

Which other company from the list above caught my attention? Dendreon (DNDN) because another well known hedge fund which is in hot water lately, SAC Capital Advisors, owns the most shares of this biotech firm which offers active cellular immunotherapy and small molecule product candidates to treat various cancers.

Which other elite funds own shares of this biotech firm? Montreal’s Sectoral Asset Management, one of the top healthcare funds in the world, as well as Orbimed Advisors, another leading healthcare fund. I also noticed Citadel Advisors who along with SAC and Farallon Capital, is among the best multi-strategy hedge funds. I like seeing this cross-activity among elite funds.

Have a look at the top holdings of SAC Capital Advisors for Q1 2011 (click on image to enlarge):

And here are the top holdings of Citadel Advisors for Q1 2011 (click on image to enlarge):

And here are the top holdings of Citadel Advisors for Q1 2011 (click on image to enlarge):

Pay attention to common holdings among these funds and common sector themes. For example, in semis, Soros is invested in RF Microdevices (RFMD), SAC Capital in Micron Technology (MU) and Citadel Advisors in Advanced Microdevices (AMD). In networking, Soros has a big stake in Extreme Networks (EXTR), SAC Capital in Lucent-Alcatel (LU), and Citadel in LSI Corporation (LSI) and Cisco Systems (CSCO). Also noticed Citadel’s stake in Toll Brothers (TOL), the largest homebuilder (betting on a recovery in housing?).

Pay attention to common holdings among these funds and common sector themes. For example, in semis, Soros is invested in RF Microdevices (RFMD), SAC Capital in Micron Technology (MU) and Citadel Advisors in Advanced Microdevices (AMD). In networking, Soros has a big stake in Extreme Networks (EXTR), SAC Capital in Lucent-Alcatel (LU), and Citadel in LSI Corporation (LSI) and Cisco Systems (CSCO). Also noticed Citadel’s stake in Toll Brothers (TOL), the largest homebuilder (betting on a recovery in housing?).

There are other common themes like software, healthcare, medical devices, financials, business services, energy and one of my favorites, alternative energy. But lately alternative energy has been getting pounded. Just check out this chart of one of my holdings, LDK Solar:

Yuck! But I know the big hedgies are accumulating positions in this and other solars which is why I tell investors to do the same: use these insane selloffs in solar shares to accumulate or initiate positions and hold on for the ride of your life! (IGNORE Jim Chanos’ dire predictions on China and Chinese ADRs!!! Jim has become the claptrap for big hedgies looking to spook investors. Made a great call on Enron, will eat his shorts on China and Chinese solars.)

Yuck! But I know the big hedgies are accumulating positions in this and other solars which is why I tell investors to do the same: use these insane selloffs in solar shares to accumulate or initiate positions and hold on for the ride of your life! (IGNORE Jim Chanos’ dire predictions on China and Chinese ADRs!!! Jim has become the claptrap for big hedgies looking to spook investors. Made a great call on Enron, will eat his shorts on China and Chinese solars.)

I’m running out of gas so let me end by looking at the top holdings of another great fund, Baupost Group, run by the legendary value investor, Seth Klarman. If you want to see a concentrated portfolio, just look at the holdings of this fund (click on image to enlarge):

One of the stocks, PDL Biopharma (PDLI) caught my attention a couple of months ago as I noticed another elite fund, Renaissance Technologies, among the top institutional holders (click on image to enlarge):

One of the stocks, PDL Biopharma (PDLI) caught my attention a couple of months ago as I noticed another elite fund, Renaissance Technologies, among the top institutional holders (click on image to enlarge):

There are many other elite funds that I’ve listed in the past which are not discussed here. Increasingly, there are sector specialists and other funds that specialize in niche strategies. The point of the last two commentaries was to give you the tools to analyze the holdings of these elite funds and allow you to invest more wisely by leveraging off this information. The information is lagged, but when elite funds are increasing their holdings of companies or initiating new positions, it’s typically because they see more upside ahead.

There are many other elite funds that I’ve listed in the past which are not discussed here. Increasingly, there are sector specialists and other funds that specialize in niche strategies. The point of the last two commentaries was to give you the tools to analyze the holdings of these elite funds and allow you to invest more wisely by leveraging off this information. The information is lagged, but when elite funds are increasing their holdings of companies or initiating new positions, it’s typically because they see more upside ahead.

Please do not forget to donate via PayPal under the banner at the top of my blog and if you want more detailed analysis, just contact me at LKolivakis@gmail.com.

Spying on Elite Funds – Part 1

It was a beautiful long weekend in Montreal. I tried to enjoy it as much as possible getting out of the house every chance I got. Even went out with some buddies of mine on Saturday night and came back in the wee hours of the morning. Haven’t stayed up that late in a long time and of course, paid the price on Sunday as I was in a zombie state pretty much all day. One thing about turning 40, you can’t party like your 20 anymore, which is something my trainer reminded me of tonight as he trained me hard and screamed “TO STAY LEAN AND MEAN, NO ALCOHOL!!!”

It was a beautiful long weekend in Montreal. I tried to enjoy it as much as possible getting out of the house every chance I got. Even went out with some buddies of mine on Saturday night and came back in the wee hours of the morning. Haven’t stayed up that late in a long time and of course, paid the price on Sunday as I was in a zombie state pretty much all day. One thing about turning 40, you can’t party like your 20 anymore, which is something my trainer reminded me of tonight as he trained me hard and screamed “TO STAY LEAN AND MEAN, NO ALCOHOL!!!”

I promised a follow-up on a few comments I started over the last two weekends, a brief intro to secrets of elite funds and keep on dancing till the world ends. This week, we’re going to delve deeper into this mysterious, secret world of elite funds as we analyze some of their recently released 13-F quarterly filings for Q1 2011. After reading this comment, and the follow-up in Part 2, you’ll be in a better position to understand what elite funds are buying and selling, and more importantly, how to use this information to your advantage.

Let me state flat out, my goal is to educate many investors, not spoonfeed them stocks to buy. Never, ever under any circumstance buy a stock blindly, even if elite funds are loading up on it. All major banks and institutions analyze 13F filings and quite often, these stocks are targeted by naked short sellers, large hedge funds and big bank prop desks which love to manipulate them up and down.

Moreover, as you will see in my follow-up comment in Part 2, I’m a heavy risk-taker. That’s me. I have no risk manager breathing down my neck and do whatever the hell I want with my money. I will ask other people’s advice, but at the end of the day, the buck stops with me and nobody else, just the way I like it (even elite funds have constraints on the positions they take on any one stock) I’ve been beaten, battered, bruised and enjoyed ups and downs, but that’s part of the game when you take inordinate risk in a very concentrated portfolio. I do this because I truly believe that over the long-term this is the way elite funds consistently beat the indexes.

Having said this, just because I am taking huge risk with my money, doesn’t mean I’m always right. I can stomach large swings in my personal portfolio and would never manage an institutional portfolio the same way or advocate that others do the same. For me, sitting in front of a computer all day trading was an extremely humbling and “real world” educational experience. Lots of senior pension fund managers have never traded for a living and they don’t understand the ins and out of trading or managing money. For them, it’s all about theory and the Efficient-Market Hypothesis (EMH). Worse still, some senior managers blindly believe in their risk models and leave no room for Black Swan events (which are occurring more frequently; instead of once every 100 years, it’s once every five years).

Only when you trade stocks, bonds, currencies, commodities and derivatives do you realize how irrelevant EMH is in the real world. The stock market in particular is heavily manipulated by big banks and their big hedge funds clients using multi-million dollar high-frequency trading platforms. Don’t for a second think it’s all clean — there is huge information asymmetry. That’s why I urge all retail investors to go back and carefully read my comment on the big secret where I offer practical advice for most investors to follow.

Also, there a lot of doomsayers who believe the world is about to end. In fact, some preacher made a prediction that it was going to happen yesterday (nothing happened, what a shocker!). Then there are those who blindly believe in “sell in May and go away”. They’re going to be proven wrong too, but for now, it seems like there are plenty of jittery investors worried about the next shoe to fall (just look at the headlines above; click on image to enlarge).

After that long preamble, let’s get to business analyzing the holdings of elite funds. Macro news is just noise; we want to focus on what elite funds are actually buying and selling. Actions speak louder than words.

Let me begin with an article that lifted my spirits up this weekend (no pun intended). UPI reports that Viagra reduces MS symptoms in animals:

Multiple sclerosis symptoms in animals with the disease were drastically reduced by the sexual dysfunction drug Viagra, researchers in Spain say.

The study, published in Acta Neuropathologica, showed a practically complete recovery occurred in 50 percent of the animals after eight days of treatment of the drug normally used in the treatment of erectile dysfunction.

Drs. Agustina Garci and Juan Hidalgo of the Universitat Autonoma de Barcelona studied the effects of a treatment using sildenafil — sold under the brand name Viagra — in an animal model of multiple sclerosis.

If given shortly after disease onset, the scientists say they observed the drug reduced the infiltration of inflammatory cells into the white matter of the spinal cord, reducing damage to the nerve cell’s axon and facilitating myelin repair.

Before you dismiss these findings, I already discussed them with my doctor friends and it turns out there is a plausible theory behind this. Viagra is a vasodilator which helps erectile dysfunction (ED) and why it may indeed help MS. Go back to read my comment on the road to liberation to understand the connection and please educate yourself on the benefits of vitamin D as it is quickly becoming linked to all sorts of conditions (check out Google news articles on Vitamin D; best in the form of D-drops in a glass of water, first thing every morning).

What does Viagra have to do with the holdings of elite funds? Why do I still have hard-on for stocks two and half years after I wrote my comment on post-deleveraging blues? Because institutions are still horny for hedge funds and still shoving billions into them, allowing them to grow larger and larger. More money flowing into directional hedge funds (L/S equity, global macro, CTA) means you will see wild gyrations in all risk assets, including high beta stocks.

I sent that Viagra article to a friend of mine and think he got a bigger hard-on than me. He owns a boatload of Pfizer stock (PFE) which has done quite well over the last year, going from $14 to nearly $21. Now, look at the top institutional holders as of March 31st, 2011 by clicking in the image below (data is free on Yahoo finance for every stock):

I note that the the world’s largest asset managers own it, Blackrock, Vanguard, Fidelity (FMR), Wellington, but I also noticed Dodge & Cox, one of the best fund managers in the world with a long-term stellar track record. They invest their own money alongside their investors and were out of technology long before the bubble burst in 2001 (it cost them some clients but they all came back).

So let’s dig deeper in Pfizer. The above just gives you a snapshot; it doesn’t tell you whether Dodge and Cox and other funds were adding to their Pfizer position during Q1 2011. In order to get this information, you go on the NASDAQ website and type in Pfizer’s stock symbol (PFE) at the top, hit enter, which brings you to this page. Scroll down the left hand side and under holdings, click on detailed institutional holdings, which will bring you to this page.

You will find the same funds listed above, along with all the other institutions that hold Pfizer shares, except now you can click on the funds and have a lot more details on all their holdings. I clicked on Dodge and Cox, which is on page 2 of the link above, and it brings me to a page that looks like this (click on image to enlarge):

I then scroll down to Pfizer and can see that they own 104,764,233 shares at the end of Q1 2011 (March 31st, 2011). Moreover, their position was unchanged. The cool thing about the NASDAQ site is that you can click on the headers at the top of each column to get even more information. For example, if you click on shares held, you will see their top holdings in terms of number of shares (click on image to enlarge):

You’ll notice that Dodge and Cox’s top holdings as of March 31st, 2011 are: Sprint Nextel, News Corp, General Electric, Boston Scientific, Comcast, Xerox, Pfizer, Vodafone, Hewlett Packard, Wells Fargo, Aegon, GlaxoSmithKline, Cemex SAB, Merck, Symantec, Time Warner, etc.

So what? This shows me that they’re heavy into big pharma now, positioning their portfolio into more defensive names (healthcare is 20% of their holdings) but they also take selective bets in banks (Wells Fargo) and technology (Symantec).

Once you have this information, you can look at the charts, see if price is above the 50-day and 200 day moving average, start tracking these companies and notice whether each dip is being bought and whether the stock keeps making news highs. Again, do not buy any stock blindly, even if elite funds are buying it, but use this publicly available information to start tracking what the elite funds are buying and to help you select a diversified portfolio of companies in all sectors. Or, if you’re a risk-taker like me, you can take more concentrated bets on a few companies.

Think I will end Part 1 here and delve into what other elite funds are buying and selling in my follow-up comment. If you enjoy these stock comments, please show your appreciation by clicking on the PayPal button which says “donate” under the pig at the top of my blog site. I welcome all financial support, large or small (PayPal calls it donation but I’m not a charity, just a blogger who writes on pensions, markets and health).

Finally, if you’re an institution, broker or family office looking to get a lot more detailed breakdown on what each top fund I track closely is buying and selling and which sectors they’re focusing on, then please contact me by email (LKolivakis@gmail.com) and I will be glad to offer you my services for a reasonable fee. I truly believe if you use this information wisely, adding some basic technical and fundamental analysis and money management principles, it will help you gain the advantage you’re looking for.

Is Private Equity Riskier than Public Equity?

Jonathan Jacob of Forethought Risk, an independent risk advisory firm, sent me a recent blog posting, Private Equity – Riskier than Public Equity?:

Jonathan Jacob of Forethought Risk, an independent risk advisory firm, sent me a recent blog posting, Private Equity – Riskier than Public Equity?:

Is private equity riskier than public equity?

What if it exhibits lower volatility? Is that lower volatility real or based on some measure of appraisal bias?

My tendency is to believe that there is a measure of appraisal bias which dampens the volatility of private equity – how many business valuation experts would mark down a private equity portfolio by 60% when the broad stock market drops by 50%? Conversely, would they mark up private equity by more than the market’s positive performance?

Two heavyweights showdown on this issue – CPP vs OMERS

CPP, on page 28 of their 2011 annual report, demonstrate how they manage portfolio risk with a private equity deal. In order to purchase $100 worth of private equity, CPP sells $130 of public equity then purchases $30 of fixed income and $100 of private equity. In their opinion, the $30 of fixed income is there “to adjust for the higher risk of embedded leverage in a private equity asset”.

OMERS disagrees. In their 2010 report OMERS states “the more predictable and sustainable performance of private market assets will underpin total Fund returns during times of depressed returns in the public markets”. (p 11)

Personally, I am not a huge subscriber to the efficient market hypothesis – I believe there are opportunities in the markets that can be exploited by those with superior ability in this field. However, I do believe that the idea of private markets as a saviour of pension funds due to its lower exhibited volatility is based on an illusion – that of an appraisal bias in the mark-to-market of those investments. If we valued these assets based on what a 3rd party would pay, that would be more reflective of reality.

I asked a senior pension fund manager to weigh in on this discussion. Here is what he shared with me:

It’s cumulative IRR that is the measure that counts. Full stop. Net of currency. Any other measure is misleading or irrelevant.